Team Sarah Health Care Bill Review Board

Comprehensive Review

H.R. 3962: Affordable Health Care for America Act of 2009

Report Submitted: 10/29/09

H.R. 3962

Affordable Health Care for America Act of 2009

Sponsor: John Dingell (D-MI)

http://docs.house.gov/rules/health/111_ahcaa.pdf

1,990 pages

SECTION I: Detailed Review of Legislation by Topic

ABORTION

Abortion Coverage (Page 110): “Nothing in this Act shall be construed as preventing the public health insurance option from providing for or prohibiting coverage of services described in paragraph (4)(A)”. Paragraph (4)(A) Abortion Services – Abortions for which public funding is prohibited. Paragraph (4)(B) “The services described in this subparagraph are for abortions for which the expenditure of Federal funds appropriated for the Department of Health and Human Services is permitted.”

SEC. 258 (a) Presumably, the Act does not appear to preempt any state laws regarding abortion. This means that if there is a state law that disallows state funding (but not Federal) of abortion, it can presumably keep that restriction in place.

Federal Funding of Abortion (Page 147) Lines 14-(1) IN GENERAL.—“Nothing in this Act shall be construed to have any effect on Federal laws regarding – (A) conscience protection; (B) willingness or refusal to provide abortion; (C) discrimination on the basis of the willingness or refusal to provide, pay for, cover, or refer for abortion or to provide or participate in training to provide abortion”. The concern regards lines 20-23 (C) as it is viewed as a potential open door for funding of organizations such as Planned Parenthood. The document affirms that this bill has no effect on current law where discrimination based on either willingness or refusal to participate in abortion services, and thus, provides no additional protect against the use of Federal funds allocated for abortion services. As, additionally, the Hyde Amendment is in no way incorporated into this piece of legislation and because no additional explicit protections exist in this document, this piece of legislation will, indeed, authorize federal funding of abortion under the public option.

Lack of HIS Abortion Funding Ban (Division D) This essentially reauthorizes the Indian Health Service, though without a specified ban on abortion funding and without any language, reference, or protection against such funding as was previously provided under the Vitter Amendment. Thus, due to the lack of an outright ban on abortion funding, there exist no protections against or prohibition of federal funding for abortion. As, additionally, the Hyde Amendment is in no way incorporated into this piece of legislation, no such protections exist.

Mandated School-Based Health Clinics (Page 1354) Lines 9-21 states, “(c) Use of Funds – Funds awarded under a grant under this section …(2) may not be used to provide abortions. However, there is no specific language prohibiting either abortion referrals or the distribution of information materials regarding access to abortion.

Secretary Determines Providers (Page 1451) Lines – “Any other type of provider specified by the Secretary, which has a desire to serve low-income and uninsured patients”. The concern is that this language is grossly open-ended and provides for organizations such as Planned Parenthood that provide abortion services.

“CADILLAC” INSURANCE PLANS"

Credit vs. Points (Pages 318-320) This portion gives the appearance of providing a temporary two-year credit while at the same time deducting “points” if the Secretary deems that the employer is too generous with its health care benefit package. Ex. p. 319, lines 11-18: “Credit not allowed with respect to certain highly compensated employees. No credit shall be determined under subsection (a) with respect to qualified employee health coverage expenses paid or incurred with respect to any employee for any taxable year if the aggregate compensation paid by the employer to such employee during such taxable year exceeds $80,000”.

COMMUNITY ORGANIZATIONS

Community-Based Organizations (Page 1374) Line 10 - 3) a State training partnership program that consists of nonprofit organizations that include equal participation from industry, including public or private employers, and labor organizations including joint labor-management training programs, and which may include representatives from local governments, worker investment agency one-stop career centers, community-based organizations, community colleges, and accredited schools of nursing”. The concern is that this opens the door for organizations such as ACORN.

DISCRIMINATION

Terminology Related to Access (Page 1318) Line 4 – “(3) The term ‘health disparities’ includes health and health care disparities and means population-specific differences in the presence of disease, health outcomes, or access to health care. For purposes of the preceding sentence, a population may be delineated by race, ethnicity, primary language, sex, sexual orientation, gender identity, disability, socio-economic status, or rural, urban, or other geographic setting and any other population or subpopulation determined by the Secretary to experience significant gaps in disease, health outcomes, or access to health care.”

END OF LIFE CARE AND IN-FACILITY CARE

(DEATH PANELS)

*Government Panel for Senior Care Decisions (Pages 649-661): The Secretary has the right to waive requirements of the Social Security Act Titles XI & XVIII. These providers will put together patient decisions aids and share in seniors’ decisions regarding their health care. Seniors will attend counseling provided by said panel. Compensation will be granted to providers who generate less cost for care with regards to Parts A and B of Medicare.

Government Regulation of Staffing in Nursing Facilities (Pages 822-826): In a specific motion to alter state authority of nursing facilities and to provide the Secretary and consumer advocacy groups with overreaching authority, this section of the bill calls for an amendment to the Social Security Act "(C) Submission of Staffing Information Based on Payroll Data in a Uniform Format." The Secretary of Health and Human Services shall require a skilled nursing facility to electronically submit to the Secretary direct care staffing information including agency and contract staff, based on payroll and other verifiable and auditable data in a uniform format as established by the Secretary in consultation with among others, consumer advocacy groups.

Government Authority in Determining Medical Home Models (Pages 680-690): Secretary is provided wide latitude to fund and create both independent and community-based medical home models in order to reward physicians and others to coordinate treatment for chronically ill patients in underserved (rural) areas. Patient need not designate a doctor as their caregiver.

Regulation of Services (Page 383) Lines 11-16 allot for using appropriate indicators for non-therapy ancillary services classification, which may include age, physical and mental status, ability to perform activities of daily living, etc. The concern is over the method of deciding care delivery, placing key decision-making elements in the hands of politicians and other non-medical staff as opposed to the hands of patients’ doctors and families.

Regulation on Patient Stay (Page 385) Establishes payment based on total costs during stay in a skilled nursing facility as opposed to the number of days in such stay.

“CLASS” Program for Assisted Living – National Voluntary Insurance Program

SEC. 3204 . Enrollment and Disenrollment Requirements

Automatic Enrollment (Page 1575) Line 3 – Individuals are automatically enrolled by their employer if they meet the following description in subsection (c) (Page 1568) - unable to perform 2-3 daily living activities, pose a threat due to cognitive impairment, or have a functional limitation “as determined under regulations prescribed by the Secretary”.

Opt-Out Option (Page 1576) – Individuals may waive enrollment “in such form and manger as the Secretary shall prescribe”.

Inability to Disenroll (Page 1579) Line 16 –Individuals may only be permitted to disenroll during an annual disenrollment period established by the Secretary.

Life Independence Account (Page 1583) Line 20 – Account established by Secretary on behalf of each eligible beneficiary for nonmedical services and supports. (Page 1584) Line 9 – “Nothing in the preceding sentence shall prevent an eligible beneficiary from using cash benefits from the (LIA) for obtaining assistance with decision-making concerning medical care, including the right to accept or refuse medical or surgical treatment and the right to formulate advance directives….living will”.

Access to Cash Benefits (Page 1589) Lines 15-19 – Secretary will allow authorized persons to receive the beneficiary’s cash benefits if the individual is considered an “institutionalized beneficiary under clause (i)”.

SEC. 3207. “CLASS Indpendence Advisory Council – Council established to advise the Secretary.

GOVERNMENT REGULATION OF HEALTH RESEARCH, INDUSTRY AND PRACTICES

Authority to Effect Price Ceilings (Pages 1341-1342) Lines 23-1 – “(i) The establishment of a process to enable the Secretary to verify the accuracy of ceiling prices calculated by manufacturers under subsection (a)(1) and charged to covered entities..”. Concern exists over lack of oversight.

Grant-Based Obesity Prevention Program (Page 1457) Lines 11-20 – “(a) Program. – The Secretary shall establish a community-based overweight and obesity prevention program consisting of awarding grants and contracts under subsection (b). (b) Grants. – The Secretary shall award grants to, or enter into contracts with, eligible entities – (1) to plan evidence-based programs for the prevention of overweight and obesity among children and their families through improved nutrition and increased physical activity; or…..(Page 1458, lines 15-17)…representatives of public and private entities that have a history of working within and serving the community”.

Government Legislation of Pain Research (Pages 1493-1501): Page 1496 describes the attributes of committee members (6 members are scientists, physicians, other health professionals while another 6 members are from general public representatives from leading in research, advocacy and service organizations for individuals with pain-related conditions). This committee will coordinate all efforts within the Department of Health and Human Services and other Federal agencies that relate to pain research. Appears to be a decision making board on treatment protocols, create a public awareness campaign on pain. Ramifications include overly regulated treatment protocols for chronic pain and the possible end result of rationing. (Page 1501): Lines 15-18 establish the authorization of appropriations – “For purposes of carrying out this section, there are authorized to be appropriated $2,000,000 for fiscal year 2011 and $4,000,000 for each of fiscal years 2012 and 2015”.

Government Regulation of Group Purchasing (Page 1340-1341) Lines 23-4 – “(C) Prohibiting the use of group purchasing arrangements. – A hospital described in subparagraph (L), (M), (N), (R), (S), or (T) of paragraph (4) shall not obtain covered outpatient drugs through a group purchasing organization or other group purchasing arrangement”. Concern exists over lack of oversight.

Required Reporting Regarding Infections Sec. 1138A – Requirement for public reporting by hospitals and ambulatory surgical centers on health care-associated infections. Page 915 – States, “infections are to be publicly posted and compared by demographic information.” Page 916 – States “infections are being studied in such detail in order to reduce costs, not because of quality of care concerns”. The concern stems from both the ambiguity that exists in the statement referenced on page 915 as well as the lack of concern over quality of care in regards to infection.

Required Reporting Trumps State Laws Sec. 1128H – Financial reports on physicians’ financial relationships with manufacturers and distributors of covered drugs, devices, biologicals or medical supplies under Medicare, Medicaid, or CHIP and with entities that bill for services under Medicare. Page 910 – Concerns is that language pre-empts state laws requiring manufacturers to report their relationships to physicians. Page 912 – Establishes that “Comptroller General” is to file a report establishing that no loopholes exist in said section.

Vernacular Change Regarding Mental Health Centers (Page 1370) – This area redefines Community Mental Health Services as “Federally Qualified Behavioral Health Centers”.

GOVERNMENT REGULATION OF NON-HEALTH INDUSTRY

Regulation of Disclosure of Nutrient Content/Menu Variability (Page 1514) Lines 5-14 – “The Secretary shall establish by regulation standards for determining and disclosing the nutrient content for standard menu items that come in different flavors, varieties, or combinations, but which are listed as a single menu item, such as soft drinks, ice cream, pizza, doughnuts, or children’s combination meals, through means determined by the Secretary, including ranges, averages, or other methods”. Rules extend to maintaining the calculation of combo meals an addition cost to restaurants.

Regulation of Vending Machine Owners/Suppliers (Page 1516) Lines 4-8 – Pertaining to businesses that own or operation 20 or more vending machines, “the vending machine operator shall provide a sign in close proximity to each article of food or the selection button that included a clear and conspicuous statement disclosing the number of calories contained in the article”.

Regulation of Food Preparation/Presentation (Page 1517) Lines 14-22 - “The Secretary shall (aa) consider standardization of recipes and methods of preparation, reasonable variation in serving size and formulation of menu items, space on menus and menu boards, inadvertent human error, training of food service workers, variations in ingredients, and other factors, as the Secretary determines”.

*HEALTH CZAR*

Health Czar (Page 133): Establishes Health Czar and bureaucracy, i.e. “Health Choices Commissioner” and “Health Choices Administration”. Essentially, this area lends the Health Commissioner and Health Choices Administration power over health insurance plans both inside and outside of the Health Insurance Exchange. The concern is that the provision invites overreaching authority and oversight of plans specifically set up to provide timely and needed care not readily available through the government exchange-controlled plans.

Health Czar Health Plan Audits (Page 133-134) Provides “Health Commissioner”/Czar with wide discretion to audit “qualified health benefits plans” and then bill the plan for the cost of the audit, regardless of grounds for the audit and regardless of whether or not the plan was found to have violated any regulation. The concern is the overreaching of authority and power over private health plans and the conjecture is that this will force private insurance companies out of business, thus significantly limiting consumer choice. As written, no protection from abuse of power in this regard is apparent.

HOSPITAL LIMITATIONS

Sec. Decides Regulations for Hospital Expansions (Page 490) With regard to hospital expansion, a “hospital may apply for an exception” for expansion. Lines 24-25 – “The Secretary shall promulgate regulations”, or create the laws to manage the expansion process. Page 491, lines 5-6 lists exceptions “up to once every 2 years”.

(Page 491) Lines 9-22 limit the size and facilities of the hospital; cannot double the size, baseline being “as of date of enactment of this subsection.”

(Page 493) Lines 12-18 appear to limit choice of hospital by limited expansion exceptions based on “average percent with respect to such admissions for all hospital located in the county in which the hospital is located”.

(Page 494) Lines 3-8 cite that expansion is also based on “average bed occupancy rate in the state.”

INDIAN HEALTH SERVICES

Government Oversight of Tribal Contracts (Pages 1850 – 1860) HEALTH SERVICES FOR URBAN INDIANS – Essentially states that the Secretary now controls and approves any and all grants and/or contracts entered into or referred by an Indian Tribe, Urban Indians or Tribal Organizations, including but not limited to healthcare needs, education of any kind, decease prevention, wild life preservation, land preservation or land purchases, and anything else covered under the 1921 Snyder Act.

(Page 1860) Lines 14-23 – “The purpose of a contract or grant...shall be the determination... in order to assist the Secretary in assessing the health status and health care needs of Urban Indians in the Urban Center involved and determining whether the Secretary should enter into a contract or make a grant....”.

Indian Health Service (IHS) Penalties Sec. 311 (d) Breach of Agreement. The concern is that there is a lack of sufficient language to determine what constitutes a breach. However, it does explain that the tribe will be liable for monies paid to them and they will seize tangible property to repay the government for what was paid out.

Indian Self-Determination Law – Link to additional information: http://www.teamsarah.org/group/healthcarebillreviewboard/forum/topics/indian-selfdetermination-law

Lack of HIS Abortion Funding Ban (Division D) This essentially reauthorizes the Indian Health Service, though without a specified ban on abortion funding and without any language, reference or protection against such funding as was previously provided under the Vitter Amendment. Thus, due to the lack of an outright ban on abortion funding, there exist no protections against or prohibition of federal funding for abortion. As, additionally, the Hyde Amendment is in no way incorporated into this piece of legislation, no such protections exist (PLEASE NOTE: This is a duplicate posting; additional posting in “Abortion” category).

Land Transfer (Page 1805) SEC. 307 – Lines 12-18 – Authorizes Bureau of Indian Affairs and all other agencies and departments of the U.S. to transfer land to the IHS for health care services (at no cost).

Mental Illness Decided by Government (Page 1884) – Directs terms for considering what constitutes mental illness; (Page 1892) – Authorizes government to convert existing hospital beds into psychiatric units if needed.

Separate but Equal? (Pages 1934) Health Services are to be "at a minimum...at parity...with health services available to and health status of general population."

Septic System Regulations (Pages 1780-1790) Congress reaffirms primary responsibility and authority of the government to provide sanitation facilities and services. Government establishes standards for such systems. It is posited that this item is a necessary item for the bill as septic-related issues directly affect health issues for the Indian Community. However, it is a concern that this is transition of power overrides local standards for the Indian Community and usurps local authority over key community infrastructure and systems. It is worthy to note, as well, that sanitation needs include a clean water source which involves a myriad of issues related to clean water and environmental concerns.

MEDICAL REIMBURSEMENT

Uncompensated Care Increase (Page 389-390) Page 389, lines 14-19 detail a “significant” decrease in uninsurance will be triggered by only 8% decrease – “There is a “significant” decrease in the national rate of uninsurance as the result of this Act” if there is a decrease in the national rate of uninsurance from 2012 to 2014 that exceeds 8 percentage points.” Page 390, lines 4-9 detail the increase in uncompensated care – “For each fiscal year (beginning with 2017) , the Secretary shall estimate the aggregate reduction in the amount of Medicare DSH payment that would be expected to result from the adjustment under paragraph (1)(A)”. This, in turn, will lower payments to hospitals in reimbursement rates.

NATIONAL HEALTH SERVICE CORPS

Sec. 2201Obligated Service Requirement (Page 1220): “The entity and the Corps member agree in writing that the Corps member will perform half-time clinical practice”. Essentially, this details “those individuals who have entered into a contract for obligated service under the Scholarship Program or Loan Repayment Program un which the individuals are authorized to satisfy the requirement of obligated service through providing clinical practice”. Essentially these individuals are obliged to work off debt in this capacity.

RATIONING

Rationing (Pages 25-26) Lines 22-25; 1-4 - “(2) INSUFFICIENT FUNDS.—If the Secretary estimates for any fiscal year that the aggregate amounts available for payment of expenses of the high-risk pool will be less than the amount of the expenses, the Secretary shall make such adjustments as are necessary to eliminate such deficit, including reducing benefits, increasing premiums, or establishing waiting lists”.

Rationing Board? (Page 111-112) SEC. 223 0 Lines 9-25; 1-10 - Establishes “Health Benefits Advisory Committee” to oversee benefits and plans. The Surgeon General will serve as Chair, along with nine Presidential appointees, nine appointees of the Comptroller General, and as many as eight Federal employees/officers.

TAXES

Employer FINE Under Mandated Excise Tax (Page 310): A $100 per day excise tax imposed on employers for each employee for whom employer fails to “satisfy the health coverage participation requirements”. Excise tax will not apply if Secretary determines even after “exercising reasonable diligence” employer was unaware of employee’s lack of participation in health coverage.

Employer Excise Tax (Pages 313-317): If an employer chooses not to provide health insurance to employees, an excise tax on the total wages paid is imposed on the employer. The excise tax percentage ranges from 2% of total payroll of $500,000 to 8% of payroll of $750,000 or more. If an employer has less than $500,000 annual payroll, he pays no excise tax.

Employer Health Coverage Tax Credit (Pages 317-319): Small business owners receive a tax credit of 50% of health insurance paid for employees whose wages are $20,000 or less per year when the employer has 10 or fewer employees. The tax credit is prorated as the amount of wages increases, leaving no tax credit for the employer when such employee's wages total $80,000 or more per year.

-

For employers with more than 10 employees, the tax credit calculated by the proratio shall be reduced by an amount in the ratio of 10 to total number of employees.

These items are in addition to the following:

Comprehensive List of Taxes in House Democrat Health Bill provided by Americans for Tax Reform (ATR)

http://www.atr.org/userfiles/102909pr-housetaxhikes.pdf

Employer Mandate Excise Tax (Page 275): If an employer does not pay 72.5 percent of a single employee’s health premium (65 percent of a family employee), the employer must pay an excise tax equal to 8 percent of average wages. Small employers (measured by payroll size) have smaller payroll tax rates of 0 percent (<$500,000), 2 percent ($500,000-$585,000), 4 percent ($585,000-$670,000), and 6 percent ($670,000-$750,000).

Individual Mandate Surtax (Page 296): If an individual fails to obtain qualifying coverage, he must pay an income surtax equal to the lesser of 2.5 percent of modified adjusted gross income (MAGI) or the average premium. MAGI adds back in the foreign earned income exclusion and municipal bond interest.

Medicine Cabinet Tax (Page 324): Non-prescription medications would no longer be able to be purchased from health savings accounts (HSAs), flexible spending accounts (FSAs), or health reimbursement arrangements (HRAs). Insulin excepted.

Cap on FSAs (Page 325): FSAs would face an annual cap of $2500 (currently uncapped).

Increased Additional Tax on Non-Qualified HSA Distributions (Page 326): Non-qualified distributions from HSAs would face an additional tax of 20 percent (current law is 10 percent). This disadvantages HSAs relative to other tax-free accounts (e.g. IRAs, 401(k)s, 529 plans, etc.)

Denial of Tax Deduction for Employer Health Plans Coordinating with Medicare Part D (Page 327): This would further erode private sector participation in delivery of Medicare services.

Surtax on Individuals and Small Businesses (Page 336): Imposes an income surtax of 5.4 percent on MAGI over $500,000 ($1 million married filing jointly). MAGI adds back in the itemized deduction for margin loan interest. This would raise the top marginal tax rate in 2011 from 39.6 percent under current law to 45 percent—a new effective top rate.

Excise Tax on Medical Devices (Page 339): Imposes a new excise tax on medical device manufacturers equal to 2.5 percent of the wholesale price. It excludes retail sales and unspecified medical devices sold to the general public.

Corporate 1099-MISC Information Reporting (Page 344): Requires that 1099-MISC forms be issued to corporations as well as persons for trade or business payments. Current law limits to just persons for small business compliance complexity reasons. Also expands reporting to exchanges of property.

Delay in Worldwide Allocation of Interest (Page 345): Delays for nine years the worldwide allocation of interest, a corporate tax relief provision from the American Jobs Creation Act

Limitation on Tax Treaty Benefits for Certain Payments (Page 346): Increases taxes on U.S. employers with overseas operations looking to avoid double taxation of earnings.

Codification of the “Economic Substance Doctrine” (Page 349): Empowers the IRS to disallow a perfectly legal tax deduction or other tax relief merely because the IRS deems that the motive of the taxpayer was not primarily business-related.

Application of “More Likely Than Not” Rule (Page 357): Publicly-traded partnerships and corporations with annual gross receipts in excess of $100 million have raised standards on penalties. If there is a tax underpayment by these taxpayers, they must be able to prove that the estimated tax paid would have more likely than not been sufficient to cover final tax liability.

SECTION II: General Observations and Additional Concerns

A substantial amount of power and authority is granted to the Secretary of Health and Human Services (HHS).

Secretary is empowered to limit funding for direct care services – page 1448 cited.

Community-based care networks appear to serve as a “middle man” – page 1454, lines 18-19 cited.

Regarding Crisis mental health services, Pg. 1371, “make available each of the following” Their items go way beyond covering primary health care issues and into community and regional services to include juvenile and criminal justice and other social services (line 15), enabling services including outreach, transportation and translation (line 18), health and wellness services (abortion?)

(Page 1371) Lines 10-11 - In order to be eligible for grant, the first item mentioned is jointly administered by a health care employer and a labor union. The second item may suggest that you could be eligible as joint health care provider or facility and a representative “organization” (p. 1373, lines 17-25 and p. 1374, lines 1-2).

INDIAN HEALTH

FINANCIAL

Grants for research, data, and trial programs for Behavioral Health for Indian Women is unlimited. (p1900)

Grant Clearinghouse has unlimited resources (p1915-1917, p 1917 line 10)

Funding for research and task force for 14 different agencies (p1924)

Program unlimited funds (p1935)

Establishment of a Native American Health & Wellness Foundation (p1967-1972) to have perpetual existence, charitable, non profit, not an agency of the US, can sue for real or personal property seizure (p1972 line 20).

Board members (11) to be compensated (p1971)

Monies to be deposited in the US Treasury. (p1976)

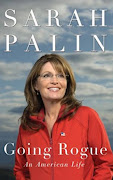

Team Sarah is a diverse coalition of Americans

dedicated to advancing the values that Sarah Palin

represents in the political process.

Come Join Us In The Fight For Conservative Values

Great Job Lady,,Keep It Up

ReplyDelete